How are you going to make a profit in your startup?

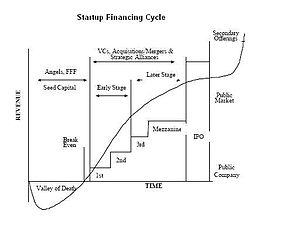

Image via Wikipedia I read an interesting post from Mark Cuban today on the problems of startup success using a free model. Back in the 90's when I was cutting my teeth around web/tech, the mantra we heard from VC's was "get big fast", and "eyeballs are everything", and "don't worry about making money, we'll …

How are you going to make a profit in your startup? Read More »